Why Market Volatility Will Remain High in 2025

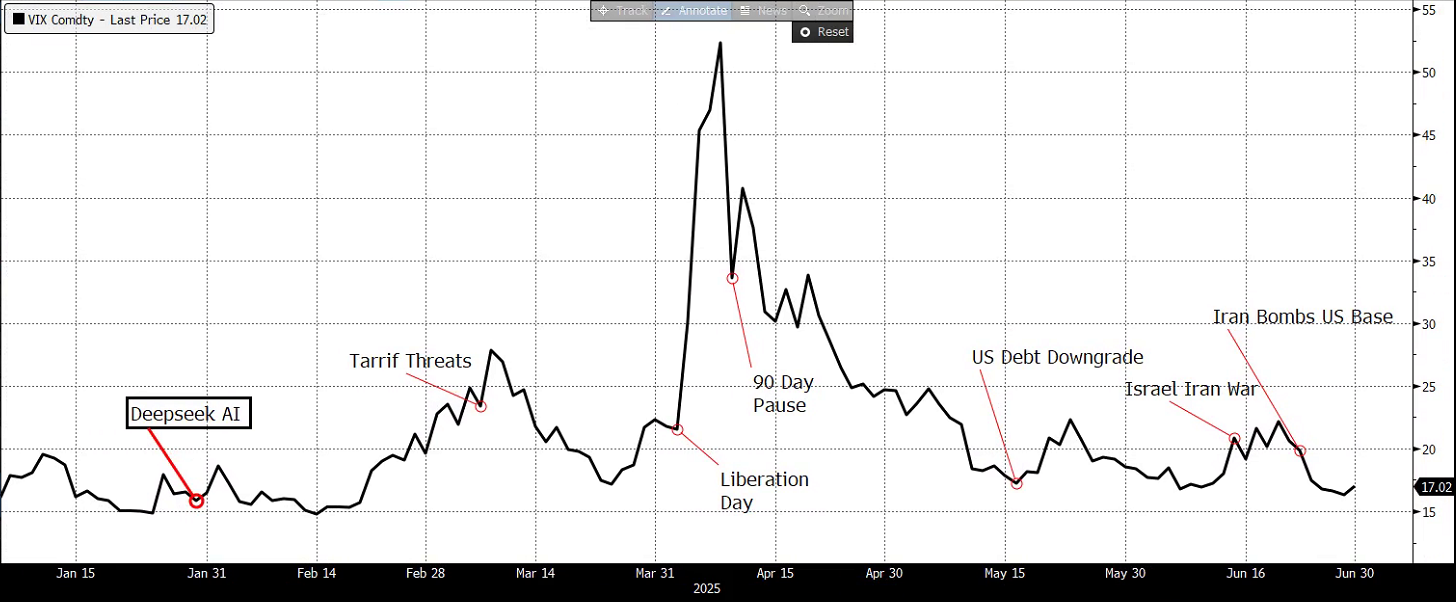

The financial markets are sounding alarm bells, demanding an effective market volatility investment strategy for 2025. Major indices have crashed through critical support levels while a perfect storm of economic and geopolitical factors converges, creating a treacherous landscape for investors to navigate. This volatility isn’t merely a temporary spike—it represents a fundamental shift in market dynamics that demands new investment approaches. As we progress through 2025, developing a resilient market volatility investment strategy will separate successful investors from those caught unprepared by the continuing turbulence ahead.

Technical Signals Flash Red

The S&P 500 and Nasdaq have both dropped below their 200-day moving averages—a technical breach that typically signals significant market weakness. While these indicators aren’t perfect predictors, they reflect growing institutional concern about market direction. Traders now watch these technical levels closely, creating a self-reinforcing cycle of volatility as positions adjust to new market realities.

Trump’s Tariff Policies Reshape Global Trade

The administration’s aggressive tariff strategy has sent shockwaves through global markets. The implementation of steep tariffs—25% on Canadian and Mexican imports and 20% on Chinese goods—creates unprecedented trade friction with America’s largest trading partners. These policies directly impact:

- Corporate profit margins as input costs rise

- Supply chain stability across multiple sectors

- Consumer prices, with PCE projected to increase 1-1.2%

The market continues to process these changes, creating sector-specific volatility as winners and losers emerge in this new trade landscape.

Economic Headwinds Intensify

Markets are digesting projections of -2.4% GDP growth for Q1 (GDPNow), signaling potential recession concerns. This economic contraction, combined with tariff-driven inflation, creates a challenging environment for monetary policy. Investors must now navigate the possibility of stagflation—a combination of slow growth and rising prices that hasn’t seriously threatened markets in decades.

Budget Deadline Creates Political Risk

The March 14 budget deadline looms large over markets. With a deeply divided Congress debating spending caps and border security measures, the threat of a government shutdown adds another layer of uncertainty. While previous shutdowns have had limited long-term market impacts, they typically trigger significant short-term volatility as investors reassess risk exposure.

Geopolitical Tensions Amplify Market Concerns

The fragile Gaza ceasefire and escalating tensions in the Taiwan-South China Sea region create additional volatility drivers. These conflicts threaten:

- Energy markets and inflation through potential supply disruptions

- Technology supply chains, particularly semiconductors

- Global trade flows in an already fragmented landscape

Markets hate uncertainty, and these geopolitical hotspots provide it in abundance.

China’s High-Stakes Economic Gamble

China’s massive $179 billion stimulus package represents a debt-fueled attempt to revitalize its economy. This approach carries significant risks that could reverberate through global markets. If successful, it might offset some U.S. market weakness. If it fails, it could trigger a cascading crisis across emerging markets, further destabilizing global financial systems.

Technology Sector Faces Policy Uncertainty

The proposed end of the CHIPS Act threatens $52 billion in semiconductor subsidies, potentially undermining U.S. technological competitiveness precisely when geopolitical tensions make domestic production more important. The technology sector, already under pressure from tariffs and valuation concerns, faces additional volatility as policy shifts create winners and losers.

Investment Strategy in Volatile Markets

In this high-volatility environment, investors must remain vigilant yet disciplined. Diversification becomes even more critical, with opportunities potentially emerging in:

- European markets less directly impacted by U.S.-China tensions

- Indian stocks benefiting from supply chain realignment

- Defensive sectors with pricing power to weather inflation

- Hedged Equity Funds that directly capitalize on market turbulence.

Long volatility funds deserve special attention in the current climate. These specialized investment vehicles are designed to perform well during periods of elevated market volatility, acting as a hedge against broader market uncertainty. Adding a 5-10% allocation to these instruments can significantly improve portfolio resilience while maintaining upside potential.

The key remains maintaining sufficient liquidity to capitalize on opportunities while protecting capital against sudden market shifts.

Looking Ahead: Volatility as the New Normal

Market volatility isn’t merely a passing phase but rather a fundamental characteristic of the current investment landscape. The combination of technical breaks, aggressive trade policies, economic contraction, budget uncertainties, geopolitical tensions, and major policy shifts has created perfect conditions for sustained market turbulence.

Investors who recognize this new reality—and adjust their strategies accordingly—will navigate these choppy waters more successfully than those hoping for a quick return to market calm. The most successful approach involves embracing volatility as an opportunity rather than merely a threat, maintaining discipline while others panic, and recognizing that periods of uncertainty often create the greatest potential for long-term returns.

Joe Tigay

Joe Tigay