What You Need to Know Before the Opening Bell – 6/7: CPI, FOMO, and Earnings Expectations

Introduction:

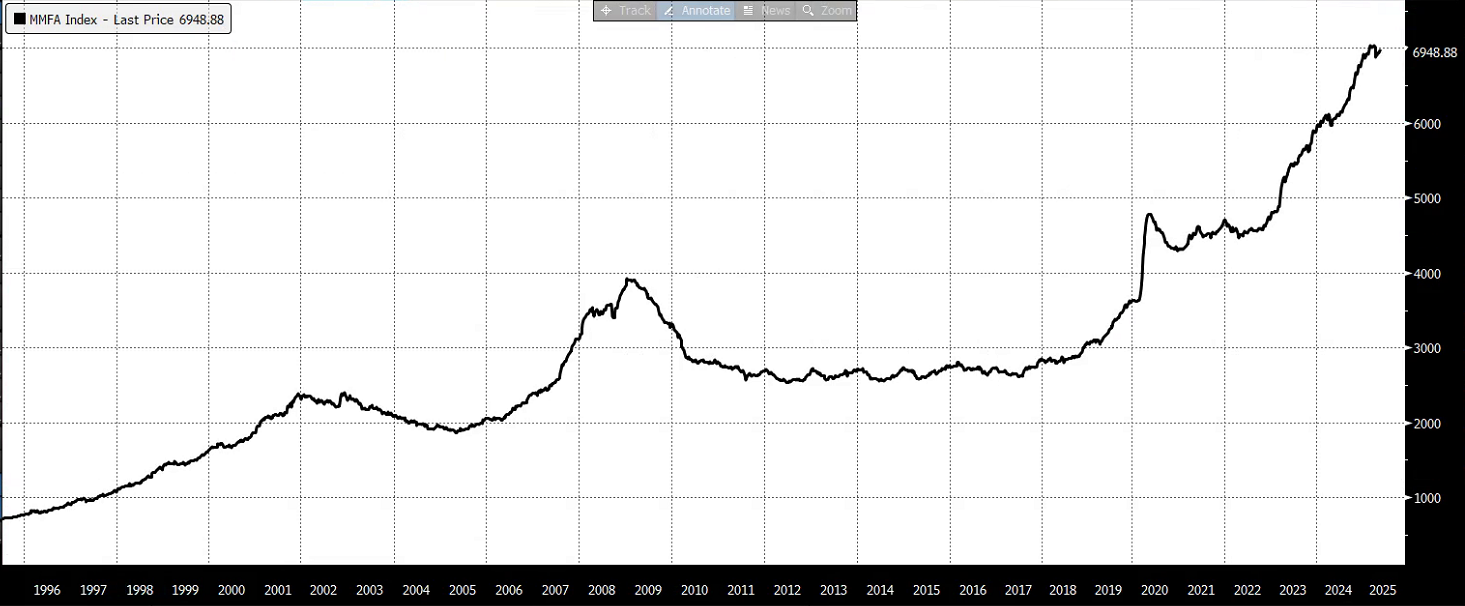

As the opening bell approaches, it’s crucial to stay informed about the key factors influencing the market. In today’s edition, we’ll discuss upcoming CPI and inflation data, the growing FOMO among investors, and the current state of the US economy. Additionally, we’ll explore the connection between earnings expectations and economic indicators, the potential impact of inflation on equities, and the significance of the 4300 level in the SPX options market.

- CPI and Inflation Data Awaited: Investors eagerly anticipate the release of CPI and inflation data, as these metrics can significantly impact market sentiment. FOMO (fear of missing out) is intensifying among investors, contributing to an all-time high in option buying, particularly in call options. Many investors are chasing the AI dream, seeking opportunities in artificial intelligence-driven companies.

- No Recession Predicted: The US economy continues to show resilience, with a growing number of economists now predicting that a recession may be unlikely. Analysts’ expectations for increased productivity driven by AI advancements have led to higher earnings expectations. It’s worth noting that the selloff in 2022 was largely attributed to an earnings recession and concerns about a slowdown in earnings growth.

- Disconnect between Economic Indicators and Earnings: A notable disconnect exists between leading economic indicators, which remain in a downtrend, and the soaring expectations for earnings. This divergence presents an interesting scenario, as experts predict a recession-free economy while inflation may not be cooling off as quickly as anticipated. Bulls find comfort in the experts’ predictions, hoping that the Fed’s tolerance for temporary inflation will benefit equities in the short term.

- Bearish Sentiment and Downside Risks: On the other hand, bears are relying on a reversal of leading economic indicators, potentially leading to a downside correction. Previous Fed hiking cycles indicate that if the economy cools off, earnings may also decline. While the strong Non-Farm Payroll report from last week showcased the economy’s resilience, the outlook remains uncertain.

- The Significance of the 4300 Level: In the options market, the SPX’s largest open interest resides at the 4300 level. This level can act as a formidable resistance, making it challenging for the market to surpass. As a key level to monitor, 4300 holds considerable importance for market participants.

Conclusion:

As the opening bell approaches, the market awaits crucial CPI and inflation data. FOMO-driven option buying and soaring earnings expectations contribute to an intriguing market landscape. With the US economy showing resilience and the potential for inflation to remain elevated in the short term, bulls find reasons for optimism. However, bears anticipate a reversal in leading economic indicators, posing downside risks. The 4300 level in the SPX options market holds significance for market participants and should be closely watched.

Remember, it’s crucial to stay informed and consider multiple perspectives when making investment decisions. The market’s response to upcoming data releases will provide further insights into its trajectory.

Brian Stutland

Brian Stutland

Joe Tigay

Joe Tigay