Diversify your risk

I attempt to be as realistic as possible as an investor. My life of following the markets began in the mid-90s when I saw the tremendous rise in prices associated with the tech boom, only to see subsequent crashes and recoveries. The lesson many have taken away from the market is buy and hold. Markets recover from crashes so hold on and wait for the recovery. It’s a realistic approach. I do believe if the time frame is long enough, then broadly U.S. equities will be higher. It is also realistic to assume, if the time frame is long enough, that we will experience extreme bouts of volatility. Once a year a steep pullback and once a decade or so a seismic volatility event. If 2020 has taught us anything, it is that the world has become more interdependent and growing increasingly more complex. An interconnected, more complex market creates more uncertainty, and increases risk. It is now more important than ever to turn to a new asset class to give investors true diversification of risk: volatility.

Volatility as an asset class

Advisors and investors have been taught forever the importance of having multiple asset classes in their portfolio to diversify their risk. Equities, bonds, real estate, and cash have been the cornerstones to modern portfolio theory for generations. Historically, bonds have been a key asset in risk diversification due to its inverse relationship to equities. Unfortunately for risk averse investors, as rates have gotten closer and closer to zero or even negative, bonds have started performing just like the rest of the risk on assets. Much like the world we live in, volatility has changed too. It is finally at a place where it can be held as an asset class to diversify risk appropriately if the right approach is used.

Volatility has been understood in different ways. Most investors think of it as the risk to owning assets. Others know it as the insurance premiums investors pay to protect a portfolio. Finally, the kids on wall street bets and reddit think of it as a YOLO (you only live once) trade to get rich quick or go broke. All the above are valid definitions. My preferred way to utilize volatility is to reduce the risk to owning risky assets. Options, and volatility trading can make investments riskier, but they can also be used to make investments less risky.

Realized and Implied Volatility

Let’s discuss volatility as simply as possible. Realized volatility is the actual movement of a stock or future over time. Implied volatility is the expected movement over time determined by options premiums. Realized volatility is how much the market moved, and implied volatility is a measure of the uncertainty of the future.

Realized volatility and implied volatility are critical components to owning volatility as an asset class. When an option is purchased or sold, the implied volatility will determine the price. The market price is the markets best guess as to how much the market will move until the option expires. The profit or loss is then determined by the gap between the actual realized movement, and the implied movement which was traded. Option trading volatility is a bet on the gap between the implied volatility and realized volatility. This was the only method of owning volatility as an asset until the introduction of VIX futures in 2004, and VIX options in 2006.

What is the VIX

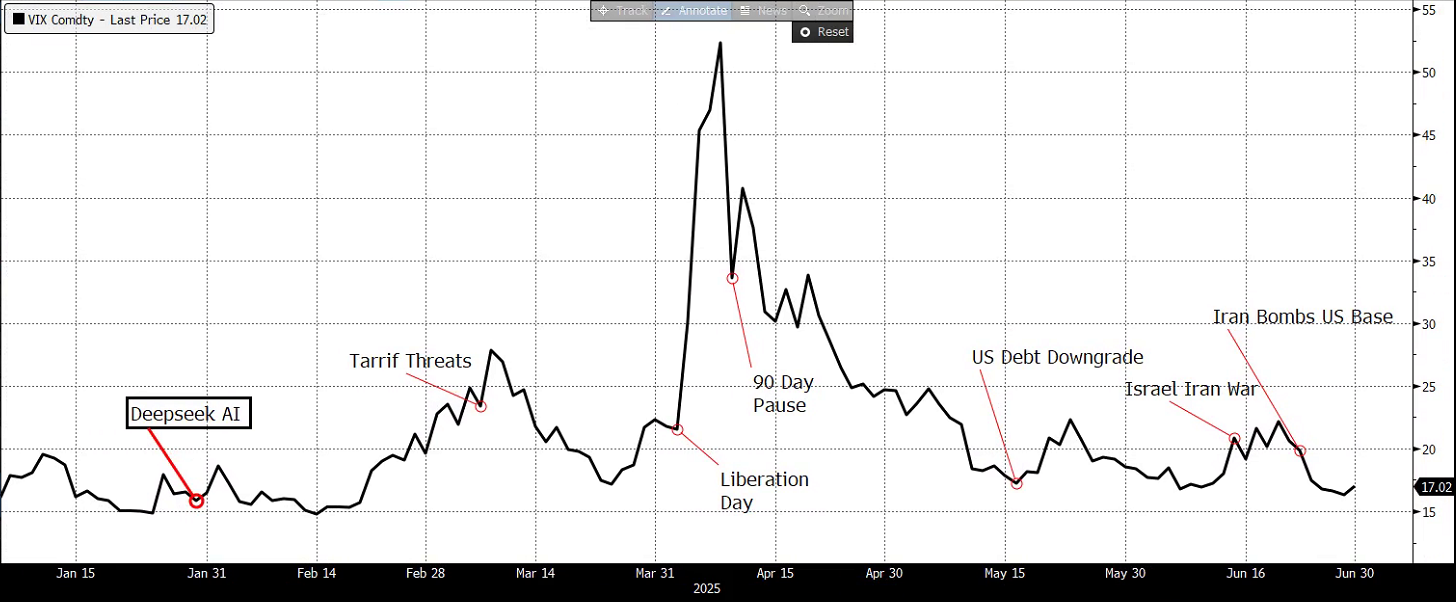

The VIX is a tool to measure implied volatility for options traders. Broadly, investors look to the VIX as market sentiment indicator. The VIX is a measurement of the next 30 days of expected market movement. The implied volatility moves independently of realized volatility, and with a very high correlation in the opposite direction of the market.

This negative correlation has been a key reason as to why VIX futures have become so popular and why billions of dollars are flowing into the VIX as an asset class. Popular exchange traded notes (ETNs) emerged granting access to everyone. Unfortunately, this became a crowded trade. Often when the market is crowded it can become cumbersome and inefficient trade. Now, 15 years in, the VIX has matured to a place where it can be held efficiently as an asset class. However, the VIX is still completely misunderstood, and even dismissed because of poor execution by traders and investors who have not understood how to best utilize volatility as an asset class.

How to Trade VIX Futures

As a former VIX market maker I was there to witness the rise of the VIX as an asset class. But the community still had a long way to go: There were 2 key problems that investors had when buying the VIX:

- The VIX futures are very hard to understand for someone who has not been following them like a market maker. They move independently of the VIX index and are only predicting the closing price on expiration. They are still very highly correlated with the VIX index, but that correlation changes the longer the time is until expiration.

- The VIX futures became a victim of their own success. Their popularity led to a crowded market which increased the negative decay associated with contango (a negative slip associated with holding futures for a long period of time).

Contango is the spread between the 2nd and front future and the reason why so many long futures trades lose money. Investors, who loved the idea of a fast pop upwards in VIX futures, were far too slow to catch onto the cost of owning VIX futures as a buy and hold investment. In the trading pits we used to say “VIX futures, you can’t be long them, you can’t be short them.”

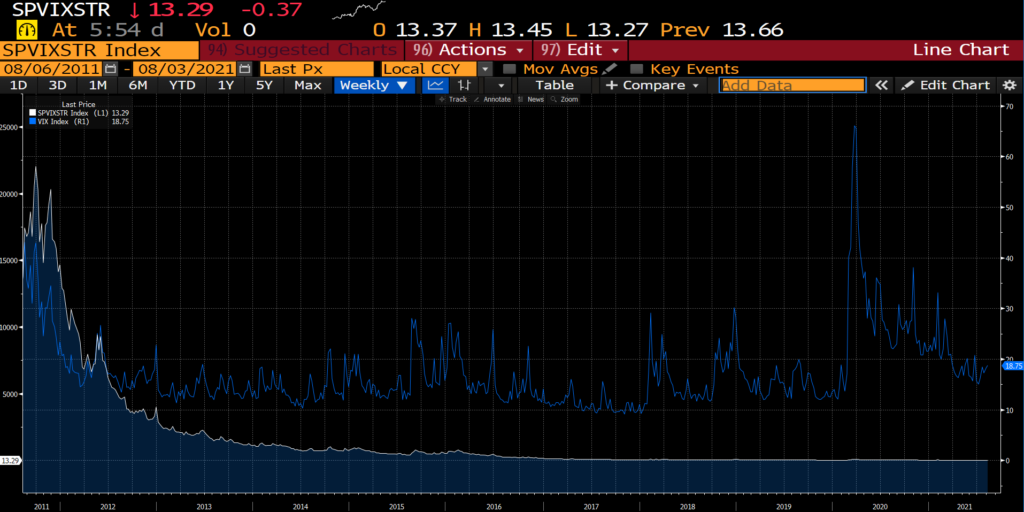

10-year chart of the VIX compared to SPVIXSTR (VXX)

Owning volatility as an asset class via implied volatility is different than other asset classes. Critically, volatility has no long-term positive expected value. Volatility does not earn anything nor pay any direct return such as interest or dividends. You cannot put your VIX future in a safe, you can’t use it to make products such as computers or jewelry, it’s just a calculation on a computer. While most asset classes over the long-term will trend higher, the VIX will ultimately wind up in the same spot. The VIX is mean reverting. The higher it goes the harder it is to go higher, and the lower it goes the harder it is to go lower.

The VIX has a very high negative daily correlation to the market. However, the longer the time frame the more the negative correlation evaporates until ultimately, we find no correlation at all. In fact, historically what we expect is most assets will appreciate over time and the VIX will stay the same. This means that owning the VIX in a buy and hold strategy does not help the long-term performance.

Active management is key to owning volatility as an asset class

The solution to owning volatility as an asset class is to make it as simple to understand as possible. A VIX futures position should remain constant, which means they need to be actively managed and actively traded. Thinking like a market maker, the VIX can be treated like a put option, the lower the stock goes for the owner of a put option more short stock exposure the option gets. A market maker would close the short stock by buying, which allows us to buy more stock when the market goes lower while at the same time reducing our volatility as it goes higher.

Actively trading the VIX with a long risk asset such as stocks keeps a portfolio appropriately risk hedged. Many hedgers do not know what to do when the VIX goes up. Should they sell the VIX because it might fall? If they do that, do they need to sell their stocks because they will be unhedged now? No, the solution is to always keep the right ratio on. Harvest the returns of being long volatility and put it back into your stocks. Buy stocks lower, sell volatility higher.

Tragically it seems that most people utilizing the VIX are hoping that the market is going to zero, and the VIX to infinity. I think they are not being realistic. The realistic view is that the market will not go to zero, instead trend higher over time.

In Summary

Consider adding volatility as an asset class to your portfolio. What’s the upside? Adding alpha to the portfolio. In order to do this, keep the volatility component at an appropriate level and maintain the allocation with an active management. The world will continue to grow more complex. Asset prices will continue to rise, and the system will continue to be shocked. I don’t know what will happen next in the market, but for those using volatility as an asset class, they are ready for it.

Joe Tigay

Joe Tigay