The Ripple Effect: Navigating the Market with a Long-Term Strategy

In the fast-paced world of finance, it’s easy to get caught up in the daily news cycle and the sensational headlines that dominate the market. However, as a portfolio manager, it’s essential to take a step back, look beyond the noise, and maintain a long-term view. In this blog, we’ll explore the importance of remaining calm, embracing volatility as an opportunity, and following a simple yet effective long-term portfolio management strategy.

-

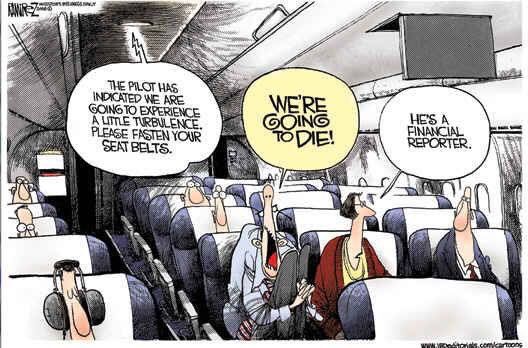

Don’t be swayed by sensationalism:

In the world of news, sensational headlines grab attention, but they don’t always provide a balanced perspective. As investors, we must remember that fear sells, and every market fluctuation is not a sign of an impending crisis. By critically analyzing daily market moves, we can identify opportunities that align with our long-term portfolio management strategy goals.

-

Embrace volatility:

Volatility is a natural part of the market’s ebb and flow. Rather than viewing it as a crisis, savvy portfolio managers understand that volatility presents opportunities for growth. By staying calm during turbulent times, we can take advantage of undervalued assets and make strategic investment decisions that align with our long-term goals.

-

Keep it simple:

A successful long-term portfolio management strategy doesn’t need to be complicated. Focus on key principles such as diversification, tax efficiency, rebalancing, and disciplined investing. By diversifying across different asset classes and sectors, managing taxes effectively, periodically rebalancing your portfolio, and staying disciplined to your investment plan, you can position yourself for long-term success.

-

Beware of behavioral biases:

Behavioral finance tells us that our emotions and biases can influence our investment decisions. It’s essential to be aware of these biases and approach investing with a critical mindset. Be open to different perspectives, challenge your assumptions, and be willing to adapt your strategy when new information arises.

Conclusion:

As portfolio managers, we need to rise above the daily noise and adopt a long-term perspective. By avoiding sensational headlines, embracing volatility, following a simple portfolio strategy, and being aware of behavioral biases, we can navigate the market with confidence. Remember, successful investing is about staying disciplined, having a plan, and sticking to it.

In a world of constant change, the ripple effect of our decisions can shape our financial future. Embrace the power of a long-term strategy and let it guide you towards your investment goals.

Stay focused, stay disciplined, and keep riding the waves of opportunity.

Joe Tigay

Joe Tigay