Market on Thin Ice

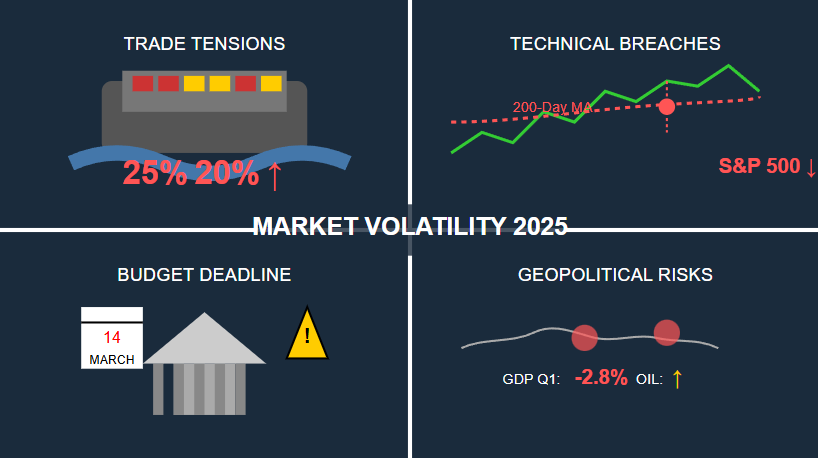

The market hangs in the balance. It’s a high-wire act, both technically and fundamentally. After touching record highs, recession fears creep in. The Sahm Rule is flashing a warning. Just 0.1 points away from signaling a downturn, unemployment needs to hit 4.2% this week to trigger an alarm.

This week is crucial. Big Tech earnings from Apple, Amazon, and Microsoft will move the market. The Fed’s decision on Wednesday is also huge. Investors want rate cuts and easy money. That’s often a recession precursor.

The problem? The government is spending like crazy, making the Fed’s job harder. Expect wild swings. Protect your portfolio.

Technically, we’re at a critical support level – the bottom of a long-term uptrend. Fundamentally, it’s a disaster zone. The Fed is about to cut rates, which is bad news. They don’t cut for fun; they cut because the economy is slowing and inflation is cooling. A slowing economy plus rate cuts equals trouble. We’ll get clues this week: the jobs report on Friday and earnings from tech giants.

Skew 2 Year

The Skew Index is possibly starting to make higher highs but not there yet. Volatility got really high by the end of the week.

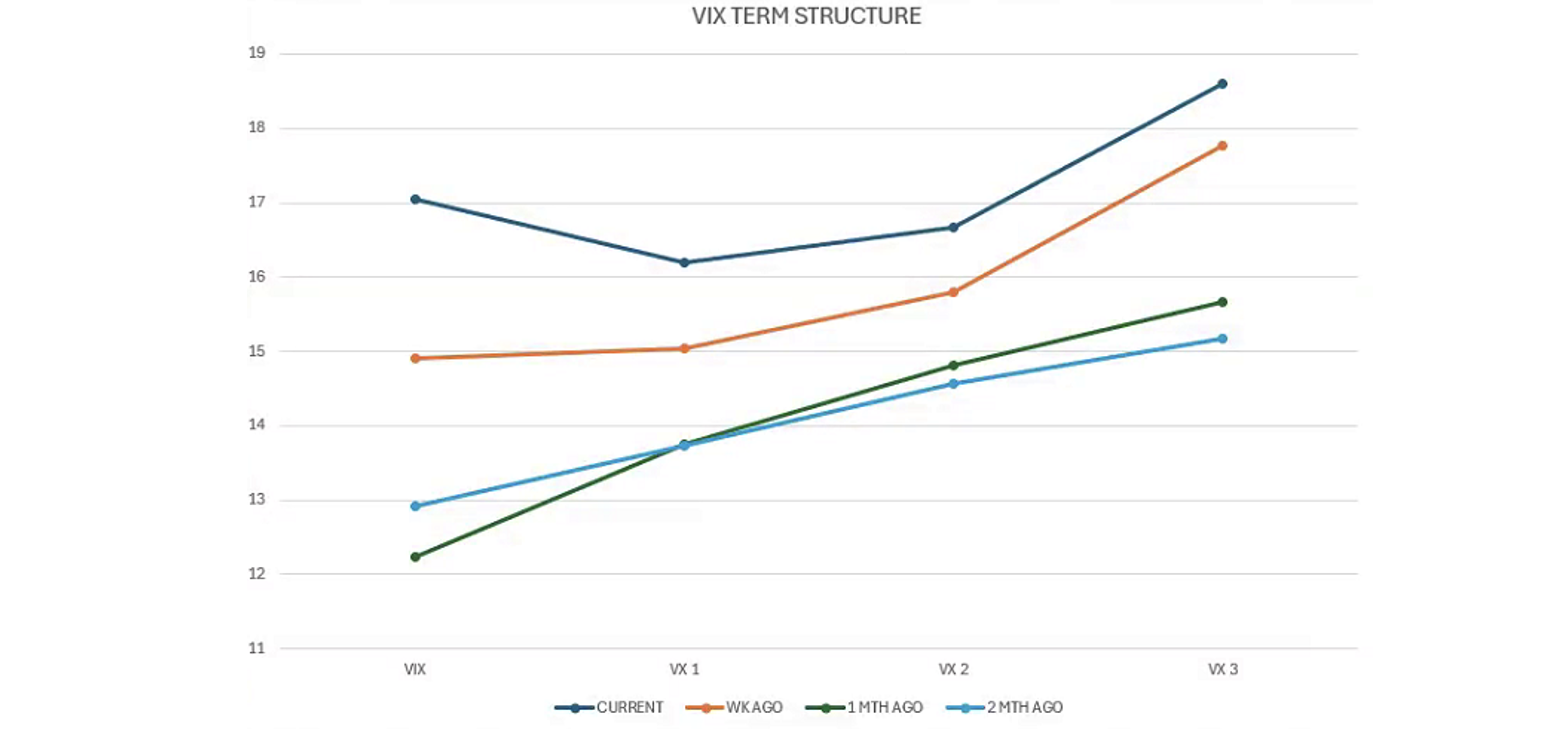

Vix Futures

Vix futures is at a very similar spot to last week. It is very steep in the second to third month. Investors expect volatility lower in the short term and higher in the long term as we move closer to the election.

SPX 2 Year Trends

After a period of decline, the index is hovering near its recent low, leaving investors uncertain about whether a strong rebound is imminent or if a false breakout is in the cards. As the market vacillates between upward attempts and sideways consolidation, options traders may find opportunities amidst the volatility. However, the looming economic landscape, particularly Friday’s employment report, will ultimately shape the market’s trajectory. The delicate balance between technical indicators and fundamental factors makes this a critical moment for investors.

MSFT Trend Line

Microsoft has been a market leader, providing support to the broader S&P 500. While it has maintained its trendline, recent shifts in short-term momentum have created uncertainty. The company’s response to the CrowdStrike incident will be crucial in determining its continued influence on the market.

QQQ Trend

QQQ is teetering on the edge of a dramatic surge or plunge. Given the potential for extreme volatility, option trading is a prudent approach to manage risk. QQQ options offer relatively lower volatility costs compared to other equities, making them an effective tool for protection. A put spread strategy can be employed to safeguard against an initial market downturn, allowing investors to maintain upside potential while limiting downside risk. A 50-point put spread provides a solid defensive position against a potential market pullback.

Joe Tigay

Joe Tigay