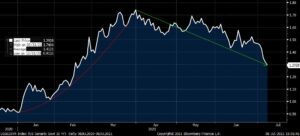

Welcome to the ripple effect where today we are talking about VIX, volatility, yield, and what to do about it as an advisor. Market commentary by advisors for advisors who also happen to be VIX experts. The VIX was absolutely flying today with all that market volatility. Why is that important for our clients? What clues can the dollar, and bond yields give us about where the market is going next? How can we prepare for it? Brian Stutland, portfolio manager of Equity Armor Investments, talks about the dollar index, VIX, 10 year interest rate note, and above all, what to do as an advisor. As I mentioned previously, with a low VIX puts have been high for some time potentially predicting this action. Also lets take a look at 10 year yeild chart, take a closer look at the change in the trend and bring it back to what to tell our clients.

Joe Tigay

Joe Tigay