Navigating Volatility: What You Need to Know for June 27th

Despite a promising start to 2023, we are now encountering warning signs as we approach the end of the second quarter. In this blog, we’ll explore key market dynamics and important factors to consider for successful navigation through volatility. Let’s dive in.

-

European Struggles and Rising Rates:

Europe’s slowing economy without a corresponding decline in inflation raises concerns. With rates continuing to climb, it’s crucial to monitor the impact on investment decisions.

-

China Stimulus and Global Growth:

China’s recent stimulus aimed to bolster its sluggish economy. However, the effects remain uncertain. I’m watching copper prices as an indicator into whether the China stimulus is transforming the global growth narrative. Copper in June has been negative, suggesting the China stimulus has had little effect on global growth expectations.

-

Volatility Reversion and the VSPKE Index:

- Volatility tends to mean revert, and we recently witnessed a bounce back from a three-year low for SPIKES. Keep an eye on the VSPKE index, which reflects the volatility of the volatility index, as historical trends suggest convergence.

-

Rotation Out of Growth:

The end of the quarter saw a modest rotation out of growth stocks. AI excitement has led the market this year to its impressive start. Some are calling it a bubble, whether or not the growth comes as expected will tell the story. And even if it is a bubble, remember the market can stay irrational longer than you can stay solvent. The previous two bubbles were popped by a recession. Eventually there will be a recession, it remains to be seen exactly when.

-

Core Inflation and Jobs Growth:

Monitoring the Federal Reserve’s actions and their impact on core or sticky inflation is crucial. Food an energy prices have come down, which helped the headline inflation number, however other parts that make up the index like services and housing have remain elevated. Core inflation coming down is necessary for the fed to be at the end of their rate hiking cycle. Historically this goes hand and hand with job losses. Job losses have not materialized yet, and inflation has come down quite a bit. This is expected to change if the fed can achieve its 2% target inflation rate.

-

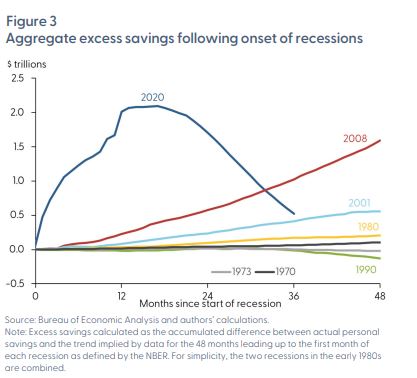

Personal Savings and Economic Impact:

Americans experienced a surge in personal savings following the pandemic, contributing to the market rally. However, savings have been declining and are expected to be depleted by September. This trend could potentially impact the economy as high rates take effect.

Navigating volatility requires a keen understanding of market indicators and their potential impact on portfolio management. Stay informed, monitor key factors, and adjust your investment strategy accordingly to maximize your returns and mitigate risks in the ever-changing market landscape.

Joe Tigay

Joe Tigay