Navigating Volatility: What You Need to Know for June 20th

Welcome back to The Ripple Effect, where we dive into key news, events, and trends shaping the markets. Today, our focus is on volatility indexes like VIX and SPIKE, along with crucial indicators for predicting future market movements. Remember, while the market generally rises over the long term, it’s important to acknowledge the significant waves of volatility that accompany it. As a portfolio manager, my role is to skillfully navigate both extremes and ensure the safety of my passengers in all market conditions.

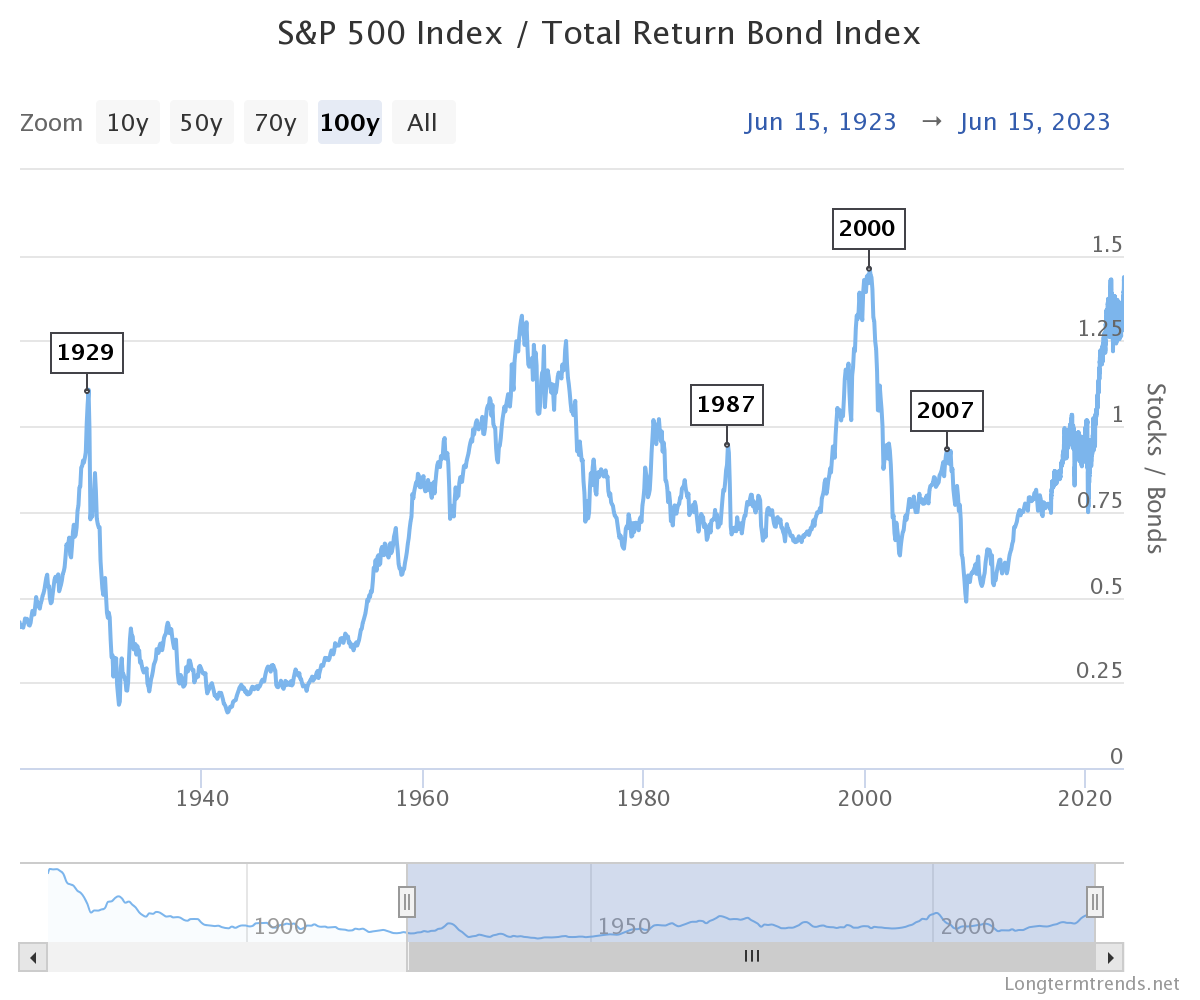

Coming out of a 3-day weekend, we typically observe a boost in volatility, as expected. Moreover, the current narrative revolves around AI’s potential to enhance stock market values through productivity advancements. Now, let’s take a look at the Contrarian Chart of the Day: the rising S&P 500 to bonds ratio is reaching worrisome levels, historically signaling market corrections. Keep a close eye on this indicator, as we’re at a point where mean reversion becomes plausible.

Another contrarian indicator worth noting is the persistent chase of FOMO, as evidenced by unusually high call volumes. Additionally, the Fear Greed Index continues to flash extreme greed, highlighting the prevailing market sentiment. On the other hand, bears are pointing at the “June Swoon” phenomenon, which historically has resulted in negative market periods following positive quarters 4 out of the last 18 times. While it may seem random, we can’t dismiss this pattern, as the market’s usual positivity calls for attention.

Considering these factors, it’s crucial to implement new protective hedges following positive quarters, especially in the period following June 19-27th. Additionally, volatility is on the rise during the June Swoon, and we’re already witnessing an uptick ahead of the opening bell. Stay alert and prepared for potential market fluctuations in the coming days.

Brian Stutland

Brian Stutland

Joe Tigay

Joe Tigay