Navigating Volatility: The Ripple Effect – June 22

Taking Control and Staying Focused

“The things you can control are your thoughts, your actions, and your attitudes.” – Epictetus

Epictetus, a Stoic philosopher, reminds us of the power of focusing on what we can control. In today’s volatile markets, it’s essential to embrace this wisdom. If Epictetus were writing the manual today, he might include advice like, “You can’t control the Fed, so don’t fight it.” Our focus should be on our research and process, having the right plan, and maintaining the right mindset to stick to that plan. By doing so, we position ourselves for success in the end.

Interest Rates and Inflation: A Global Challenge

Around the world, interest rates are on the rise, creating waves of uncertainty. In Europe, inflation remains stubbornly high, while in the United States, it’s not declining as predictably as the Federal Reserve had hoped. Jerome Powell’s recent testimony to Congress reinforced the expectation of two more rate hikes, underlining the Fed’s commitment to normalize monetary policy.

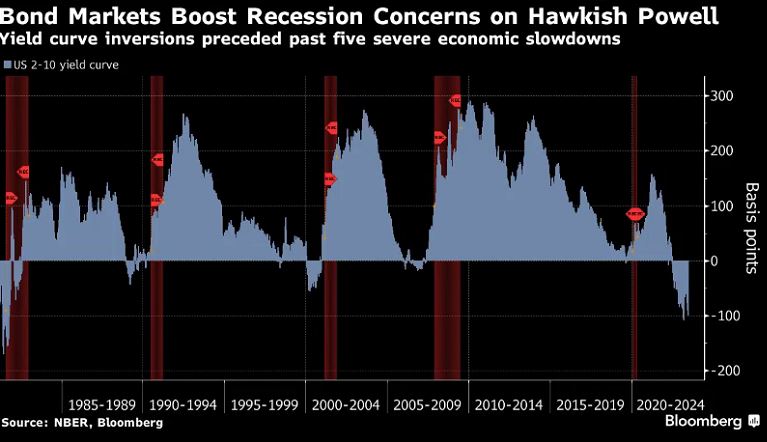

The Yield Curve Inversion: A Key Indicator to Watch

One critical indicator to keep a close eye on is the growing inversion of the 2-10 yield curve, which now stands at 100 basis points. Looking back at historical data from 2000 and 2007, recessions did not commence until the yield curve reverted to a positive slope. It remains uncertain if this time will be different. An inverted yield curve suggests that short-term rates may soon decrease. Historically, rates decline when the economy slows down, and the Fed’s concerns about inflation ease. The big question is whether the Fed will lower rates before inflation is under control to stimulate the economy. Speculations are circulating, and some investors are turning to gold as a way to navigate this potential risk.

Embracing Our Role in a Volatile Market

As we navigate through market volatility, let’s remember that we can’t control external factors like the market’s behavior or the actions of others. What we can control is our own research, our process, and our attitude towards risk. By having a well-defined plan and the discipline to stick to it, we position ourselves for long-term success.

The market will do what it will do, and our role is to focus on what we can control. Let’s stay informed, adapt to changing conditions, and remain committed to our strategies. By doing so, we empower ourselves to navigate the ripple effects of volatility and make sound decisions that align with our financial goals.

Thank you for joining today, don’t forget to subscribe for daily updates and share this with a friend.

Joe Tigay

Joe Tigay