As we move into the second quarter of 2023, investors are faced with a challenging path forward in the current macro environment. The stock market has been on a wild ride, with significant volatility and uncertainty. The bulls are grappling with a range of challenges, including an economic slowdown, rising inflation, and geopolitical risks. While there are reasons to remain optimistic about the market’s future prospects, the path forward is narrow, and there are no guarantees. In this blog, we will explore the current macro environment and the challenges facing the bulls in detail. We will also examine the potential path forward for the market and offer some insights on how investors can navigate this challenging terrain.

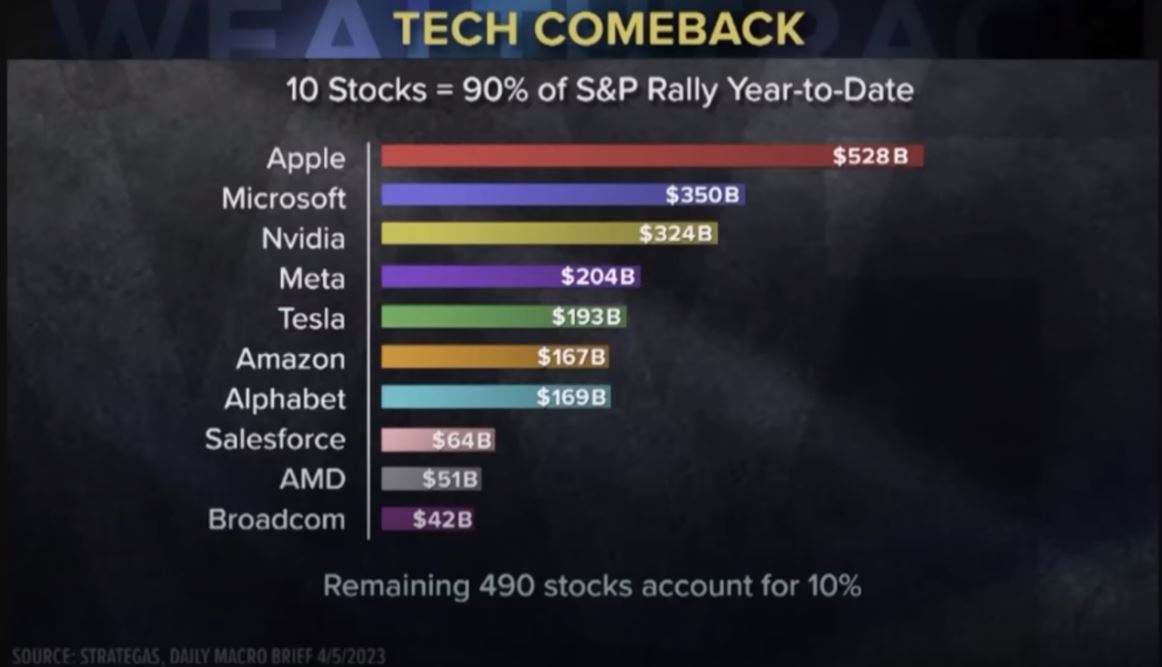

Bulls are indeed looking at the tech comeback in 2023 with excitement, and there are reasons to be optimistic. The technology sector has shown strong resilience and innovation over the past couple of years, and it is expected to continue to grow in the years to come. However, there are a couple of challenges that tech bulls should be aware of. The first challenge is related to yields. The tech sector and yields tend to trade hand in hand, with the lower yields being more favorable for the tech industry. Currently, the bond market is pricing in more than one cut in 2023, while the Fed has been adamant that there will be no cuts. If the bond market corrects itself to be in line with the Fed’s stance, this could be a concern for tech bulls. The second challenge is the narrow breadth of the tech rally. This is a broader concern for the overall S&P 500 index, in fact, only 10 stocks have contributed to 90% of the rally in the S&P 500 year-to-date. A broader gain for all stocks in the index would be more favorable for stronger economies and markets.

This week, the focus is on regional banks, which have been under pressure this year. However, last week, we saw good news from the big banks, particularly JP Morgan, which had a blowout quarter. Despite this, the current environment for the bulls is challenging, as we are in the late expansion of the business cycle, with the Fed having raised rates to very close to their target rate and getting ready to pause.

The yield curve has been severely inverted for a long time, and gold has had a fantastic run up as traders prefer owning the precious metal to dollars or stocks. Most people believe that the bond market has it right, and the Fed will need to lower rates quickly to correct the coming recession. So, what is the path forward for the bulls?

In spite of the numerous challenges facing the bulls in the current macro environment, there is a narrow path forward. A strong economy, coupled with quickly moderating inflation, could provide the Federal Reserve with the foundation to aggressively lower rates without triggering concerns about inflation. This would create a favorable environment for further market growth, which could benefit investors who remain vigilant and use volatility to their advantage. While the path forward is challenging and uncertain, there is reason to remain optimistic, and the bulls can navigate this terrain by staying focused on protection, diversification, and risk management.

As we head into the rest of the year, the SPIKES Index, which measures expected volatility in the SPY over the next 30 days, is close to post-pandemic lows, and at a level not seen since January 2022. Investors are calmed by resilient jobs growth and moderating inflation, which have helped to ease concerns about the economic outlook. However, there are still many challenges facing the market, and investors must remain vigilant in the face of uncertainty. Despite the recent stability, volatility can still spike unexpectedly, so it’s important to stay focused on protection, diversification, and risk management to navigate the current environment.

In conclusion, the path forward for the bulls in the current environment is challenging, but not impossible. A strong economy, coupled with low inflation, could provide the necessary conditions for further market growth. However, it’s important to remain cautious and use volatility to your advantage. As always, the best approach for investors is to stay focused on protection, diversification, and risk management to navigate the current environment.

Joe Tigay

Joe Tigay