Hedged Equity, The difference between long volatility and short volatility strategies.

Hedged Equity Strategies are long stock strategies with the goal of equity returns and downside protection. When I talk to advisors and I ask them if they know about options they often say, well enough to be dangerous. When it comes to trading options knowing a little is worse than knowing nothing. Options have risks, and trade offs, but advisors aren’t experts in volatility, and therefor don’t always chose the right strategy for the right client. Options trading in a system is a volatility bet, not a directional bet.

For advisors; hedged equity is a way to stand out for clients. Index ETFs are so cheap, clients are asking why should I pay to have anyone manage my money. Advisors know the value in risk mitigation, and have the skillset to understand more complex strategies.

Options take a week to learn, and a lifetime to master.

For volatility traders, there isn’t a difference between a call and a put, there is only buying options and selling options. This is known as synthetics. Any call option can be turned into a put option, and any put option can be turned into a call option. A market maker will trade the delta, or price sensitivity, of the option to turn it into a combination of a put and a call that has no directional bias, only a volatility bias.

Every option traded is a volatility bet. Selling an option is a bet that volatility will be less than what was traded until expiration, and buying the reverse.

Selling options add income with downside risk. Buying adds protection for a cost. It is the advisors job to know the difference, and how their funds are being hedged.

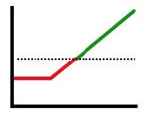

Hedged Equity with Short Vol, (Buywrite)

A Buy-write is typically a covered call strategy. This of course is a short volatility strategy and is utilized by investors more interested in income than growth. The upside is the strategy collects income by selling volatility. The downside risk is the same as being long stock with the advantage of collecting premium. The end result is modestly lower downside. Alternatively, the disadvantage is there is limited upside potential, and unlimited downside risk. Critically, it is important to ask if this fund takes on any extra risk than the market. If it trades on leverage a fund that is supposed to reduce risk, will have the potential of increasing it.

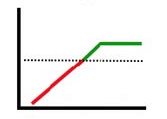

Hedged Equity with Long Vol, (Putwrite)

Put-write is known as a married put strategy. Long stock long puts. Synthetically this is the same as long an in the money call. This is a long volatility strategy which has the advantage of unlimited upside potential and has limited downside risk. The downside is there is a cost to this strategy, just like any insurance it costs money to maintain it. Critically, for long volatility, it is important to know how active this strategy is. If the strategy is passive the odds of missing the volatility increase. Volatility is priced in potential daily movements, if the strategy is only traded once a month or less, than the potential for achieving returns on volatility is greatly reduced.

Combined Long and Short, (The Collar)

Finally a Collar strategy combines a buywrite and a putwrite. It has a both a limited downside and a limited upside. The cost of the downside protection is cheaper because of the upside cap. And the upside cap is narrower due to buying a put.

Hedged Equity, when done right, is about achieving close to equity returns, while mitigating downside loss. Risk Vs Reward as usual is the name of the game. Finding a fund that can limit risk and give excess returns is the best way for an advisor to add value to their clients.

Joe Tigay

Joe Tigay