The Soft Landing

As the aviation industry knows all too well, achieving a soft landing is a delicate process that requires skill and precision. The same can be said for the Federal Reserve’s efforts to bring down inflation while maintaining economic growth. But can they do it without triggering a recession or significant job losses?

The answer is yes, but it won’t be a smooth ride. The Fed will need to raise interest rates and convince the market that rates will be higher in the long run, which will lead to fewer loans at higher rates and some turbulence. However, if they execute their strategy successfully, it will mean inflation down and the economy still in good shape. And as the economy weakens, there will be more opportunities for the Fed or government action to put out the fire by adding liquidity, further helping to achieve a soft landing.

The Turbulence

The regional banking crisis was the first instance of turbulence caused by the Federal Reserve’s efforts to achieve a soft landing. The sharp rate increases that were implemented to slow down the economy and reduce inflation caused major problems for some regional banks. This highlights the fact that reducing inflation and achieving a soft landing is not an easy task. However, every step back presents an opportunity for the Fed to react and adjust its strategy.

Small movements by the pilot can cause big movements in the plane, and the same can be said for the economy. Therefore, the Fed must continue to be proactive and flexible in response to economic conditions as it navigates towards achieving a soft landing.

However, there are concerns that the Fed may cave to public and political pressure and ease too soon, preventing inflation from falling down to their 2% target. But with careful consideration and strategic action, a bumpy but soft landing could be within reach.

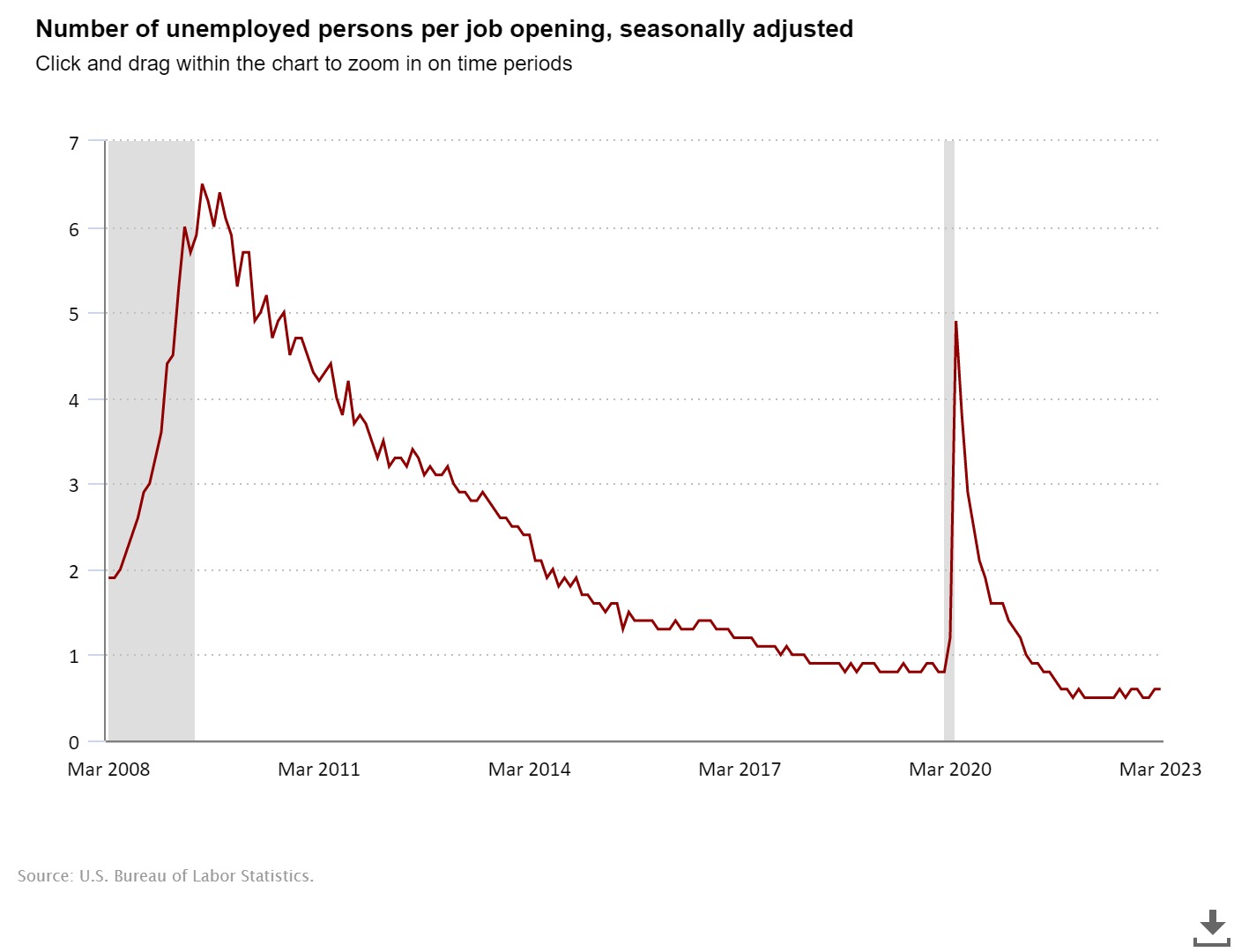

Fortunately, the current state of the job market is helping the Fed’s case, as job openings remain at a record high and job losses have remained relatively muted. This has provided the Fed with some leeway to continue their efforts to reduce inflation without causing a sharp downturn. And with technological advancements like AI and global growth in places like India and Africa, there is optimism that inflation can fall while keeping the economy flying high.

Conclusion

Achieving a soft landing is a delicate balancing act, much like the process of landing a plane. But with careful execution, flexibility, and proactive response to economic conditions, the Fed can successfully reduce inflation without causing significant job losses or a recession. And with the current state of the job market and technological advancements, there is optimism that a soft landing can be achieved.

Joe Tigay

Joe Tigay