The Looming Impact of Nvidia’s Earnings on Market Sentiment

As Nvidia’s earnings report approaches, all eyes are on its potential impact. The semiconductor powerhouse has fueled the recent market rally, but shifting investor sentiment is sparking doubts about whether this momentum can be sustained. With the Fed signaling an imminent policy shift following Jackson Hole, we stand at a critical juncture. The market could either hit all-time highs or face the onset of a bear market. This may sound dramatic, but the stakes are high with this week’s report.

Consider the S&P’s 2-year trend: we’ve seen a false bear flag after breaking below the upper trend line and a notable reversal in volatility, which suggests the potential for upward momentum and a major rally. However, this could also be another misleading signal. Notably, semiconductors have lagged recently—a possible precursor to the broader market selloff. It’s crucial to analyze these developments carefully as we approach Nvidia’s earnings.

The Yenmageddon Aftermath and Market Recovery

Following the significant market downturn triggered by the “yenmageddon” in early August, we’ve witnessed a remarkable recovery. Volatility has been high, but the overall trend has been upward. Nvidia’s strong performance and the broader tech sector’s resilience have played a pivotal role in this rebound.

Navigating the Fed’s Crossroads: Lessons from Past Rate Cut Cycles

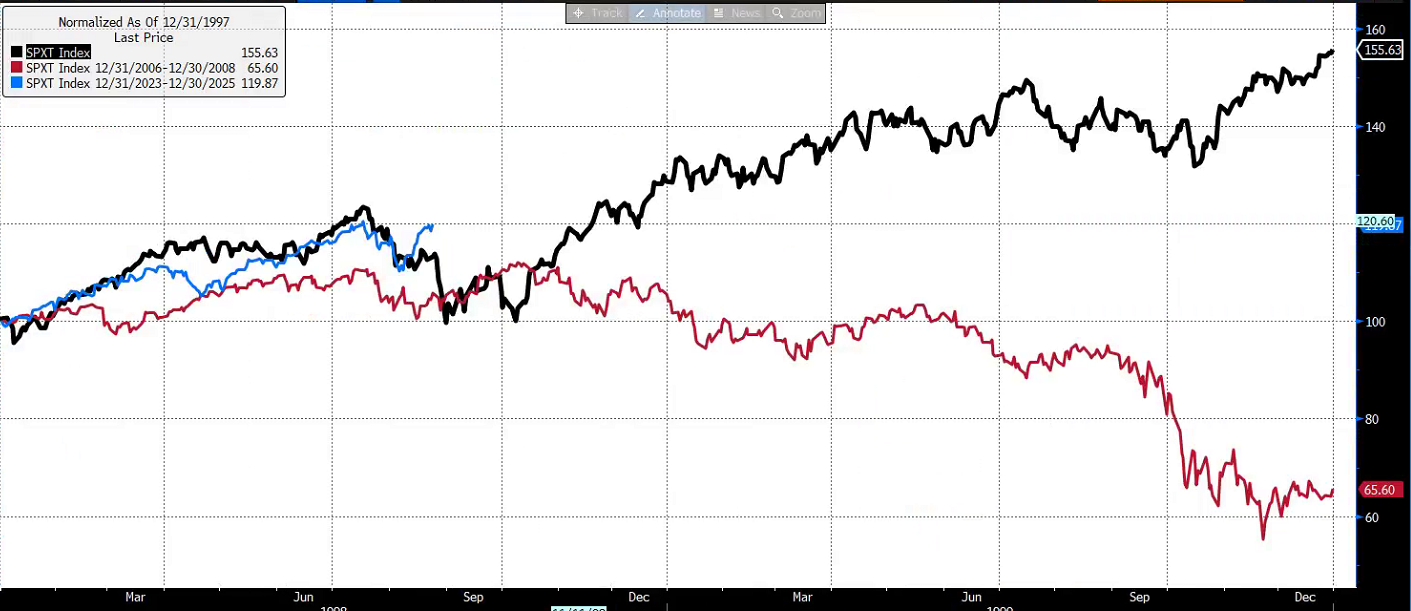

As the dust settles from the recent Jackson Hole Economic Symposium, financial markets are abuzz with speculation about the Federal Reserve’s next move. The central bank’s decisions are pivotal, and with recent discussions hinting at potential interest rate cuts, we find ourselves at a crossroads reminiscent of two significant historical inflection points: September 1998 and September 2007. While these events occurred in vastly different economic contexts, their outcomes provide valuable insights for navigating today’s economic landscape.

The Historical Context: A Tale of Two Rate Cuts

September 1998: A Boom in the Making

In September 1998, the Federal Reserve, under Chairman Alan Greenspan, cut interest rates amid a turbulent global economic backdrop. The move came as the dot-com bubble was in full swing and the tech boom was driving unprecedented market exuberance. The rate cut was a response to financial instability caused by the Russian default and the collapse of Long-Term Capital Management (LTCM), a major hedge fund.

Despite the global turmoil, the domestic economy was thriving. The tech sector was expanding rapidly, and the stock market was soaring to new heights. The Fed’s decision to cut rates was aimed at mitigating the risk of a potential recession, but instead, it provided additional fuel for an already overheated market. This led to an even more pronounced speculative frenzy, culminating in the dot-com bubble’s spectacular rise and eventual crash in 2000.

September 2007: A Different Scenario

Fast forward to September 2007, and we encounter a very different economic environment. The Federal Reserve, led by Chairman Ben Bernanke, decided to cut rates as the U.S. economy faced mounting stress from the housing market collapse and early signs of a looming recession. Job losses were beginning to pile up, and financial instability was becoming more apparent.

The 2007 rate cut was an attempt to stave off a deeper economic downturn, but unfortunately, it came too late. The housing market continued to deteriorate, and the financial crisis fully unfolded in 2008. The Fed’s actions were insufficient to prevent the Great Recession, and the subsequent economic fallout was severe and prolonged.

Parallels to Today’s Situation

As we analyze the current economic landscape, it’s crucial to draw parallels with these past instances. Today, the Federal Reserve is contemplating rate cuts amidst a complex economic backdrop. On one hand, we are witnessing signs of an economic boom similar to the dot-com era, with rapid growth in certain sectors and robust market performance. On the other hand, there are growing concerns about job losses and potential signs of economic stress reminiscent of 2007.

Key Similarities:

- Market Performance and Economic Context:

- 1998: The economy was buoyed by the tech boom, despite global uncertainties.

- Today: Certain sectors are thriving, and the market has shown resilience, albeit with concerns about underlying economic stress.

- Timing of the Rate Cuts:

- 1998: The Fed cut rates amidst a booming market to address external shocks.

- 2007: The Fed cut rates in response to rising economic vulnerabilities and job losses.

- Today: The Fed’s potential rate cuts are being considered amidst a complex economic scenario with mixed signals.

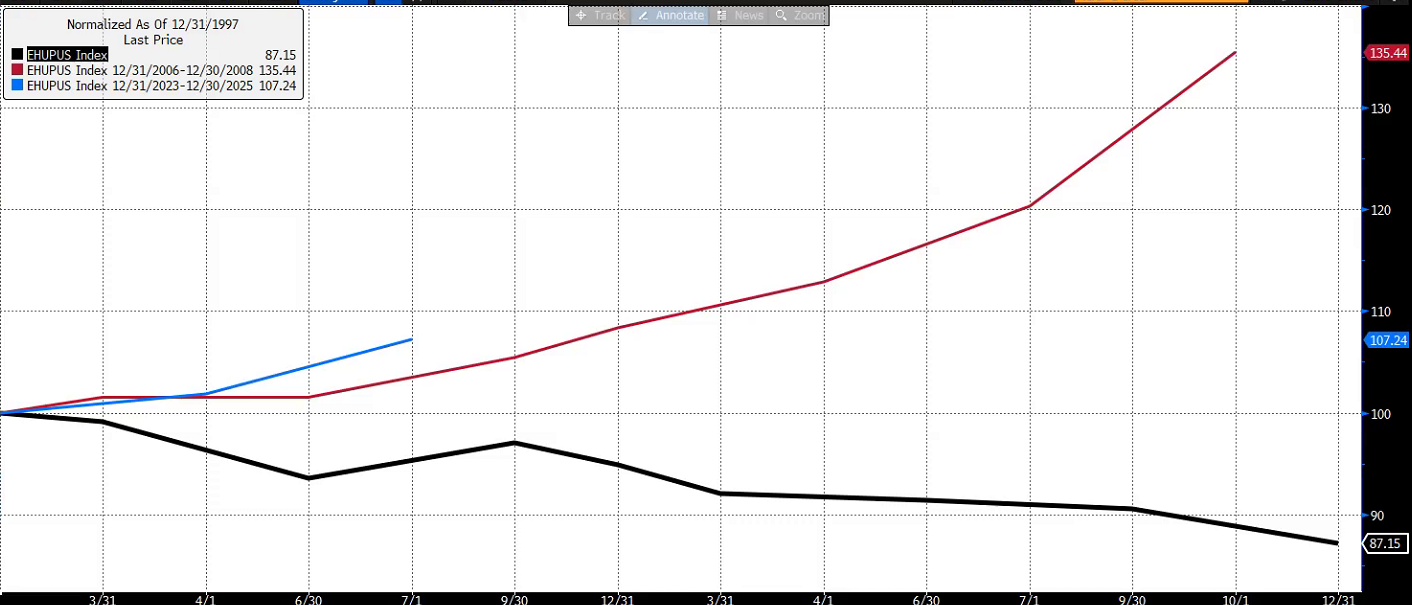

To me, the real game-changer will be jobs and the unemployment rate. Take a look at the chart of the unemployment rate comparing the three years below:

- 1998 (in black) shows a robust economy. Rate cuts during this tech boom were beneficial in the short term, fueling optimism and growth.

- 2007, (In red) in contrast, saw rate cuts that came too few and too late. The economy was already struggling, and the Fed’s efforts couldn’t keep up with the escalating crisis.

So, the pressing question today is: Is the Fed making the right move? Will their rate cuts be sufficient to minimize job losses and stabilize the economy? The answer to this could determine whether we see continued growth or face significant challenges ahead.

Key Differences:

- Economic Conditions:

- 1998: The economy was experiencing robust growth and market exuberance.

- 2007: Economic indicators were showing signs of a downturn, with rising unemployment and housing market distress.

- Today: The situation is nuanced, with strong sector-specific growth but broader economic concerns.

- Potential Outcomes:

- 1998: The rate cuts contributed to a further market surge before the eventual tech bubble burst.

- 2007: The rate cuts failed to prevent the onset of the Great Recession.

- Today: The outcome will depend on how the Fed balances the immediate economic concerns with long-term stability.

Looking Ahead: What Can We Expect?

As we stand at this crucial juncture, the Federal Reserve’s decisions will significantly impact the economic trajectory. If history teaches us anything, it’s that the timing and context of rate cuts are critical. The Fed’s approach must navigate a fine line between fostering growth and preventing overheating or deepening existing vulnerabilities.

Investors, businesses, and policymakers alike should stay vigilant and informed. While historical parallels provide valuable insights, each economic cycle is unique. Understanding the nuances of today’s economic environment and the Fed’s strategy will be key to making informed decisions and preparing for potential outcomes.

A Stalling Rally Ahead of NVDA Earnings

However, in the lead-up to Nvidia’s earnings announcement, we’ve observed a noticeable shift in market dynamics. Investors have begun to rotate out of growth stocks, including tech and semiconductors, and into value-oriented sectors. This rotation has coincided with a stalling rally, raising concerns about a potential correction or a more significant shift in market sentiment.

Is This a Consolidation or Something More?

The question on everyone’s mind is whether this recent rotation is merely a short-term consolidation or a harbinger of a more significant market shift. Several factors could be influencing this trend:

- Profit-Taking: As the market has rallied, investors may be taking profits on their gains, especially in high-flying tech stocks.

- Valuation Concerns: Concerns about the valuation of certain tech stocks, particularly those that have seen significant price increases, could be driving the rotation.

- Economic Uncertainty: The ongoing economic uncertainty, including concerns about inflation and interest rate hikes, may be prompting investors to seek safer havens in value stocks.

- Nvidia’s Earnings Expectations: The market’s expectations for Nvidia’s earnings report could also be playing a role. If the company’s results fall short of expectations, it could trigger a sell-off.

The Importance of Nvidia’s Earnings

Nvidia’s earnings report holds significant weight in the market. A strong performance could reignite the rally in tech stocks, while a disappointing result could lead to a broader market sell-off. Investors will be closely watching the company’s revenue growth, profit margins, and guidance for the future.

Joe Tigay

Joe Tigay