What happens when the fed begins a new rate hiking cycle?

Rate Hike Cycle

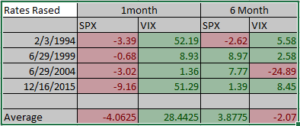

I went back and looked at the past 4 times the Fed started a rate hiking cycle. Here is what I found. 1 month later the SPX is down on average 4.06%. The best month was down .68% in 1999 and the worst month was down 9.16% in 2015. The VIX over these four periods twice saw a 50% spike.

Historically, when rates rise it’s because the economy has recovered. 6 months after a start of a rate hike cycle we see the SPX up an average of 3.87%. Bigger bounce than on the surface, considering starting down in month 1. In 3 of the 4 occasions the VIX is higher still 6 months later.

Fed Put Eliminated

The Fed put has provided a tremendous amount of support since the great recession. The Fed has been very accommodative every time there was the hint of a selloff in equities. Now, with inflation at 40-year highs, the market can no longer count on the fed stepping in and preventing a bear market. However, this could be even trickier than at first glance. While the fed has maintained that they are serious about getting inflation under control, the market is showing signs It does not believe the fed when they say they are going to put inflation ahead of equities. The result will be a higher baseline for Volatility.

Stocks can go up and down

The market is going to be a lot more volatile going forward. In an inflationary environment, where the cleanest shirt in the world is US equities, investors must stay in the market. While we are most concerned about the risk of a 40% decline in equities, we also know that there is risk to being in cash when inflation is running at 7%, and equities could continue higher with everything else priced in dollars.

Ride out the bumps with a volatility hedge

Historically bonds have been adequate hedge to equities. Unfortunately for traditional 60-40 investors that correlation has evaporated over the past decade. Even adding to risk when liquidity is stressed. Volatility continues to be a pure negatively correlated hedge for those interested risk control.

We know this cycle will be different. What we don’t know is how fast will inflation come down? How fragile is the growing economy? Will the fed change its tune and come to the markets rescue one more time even if inflation does not subside?

Joe Tigay

Joe Tigay