Brian Stutland, contributor to CNBC’s Options Action shown on Fridays, recommends to take advantage of high premium of option when VIX is above 40. Specifically, he recommends selling naked puts such as July SPY 105 puts and use the proceeds to invest in treasury bond; or sold covered calls for QQQQ.

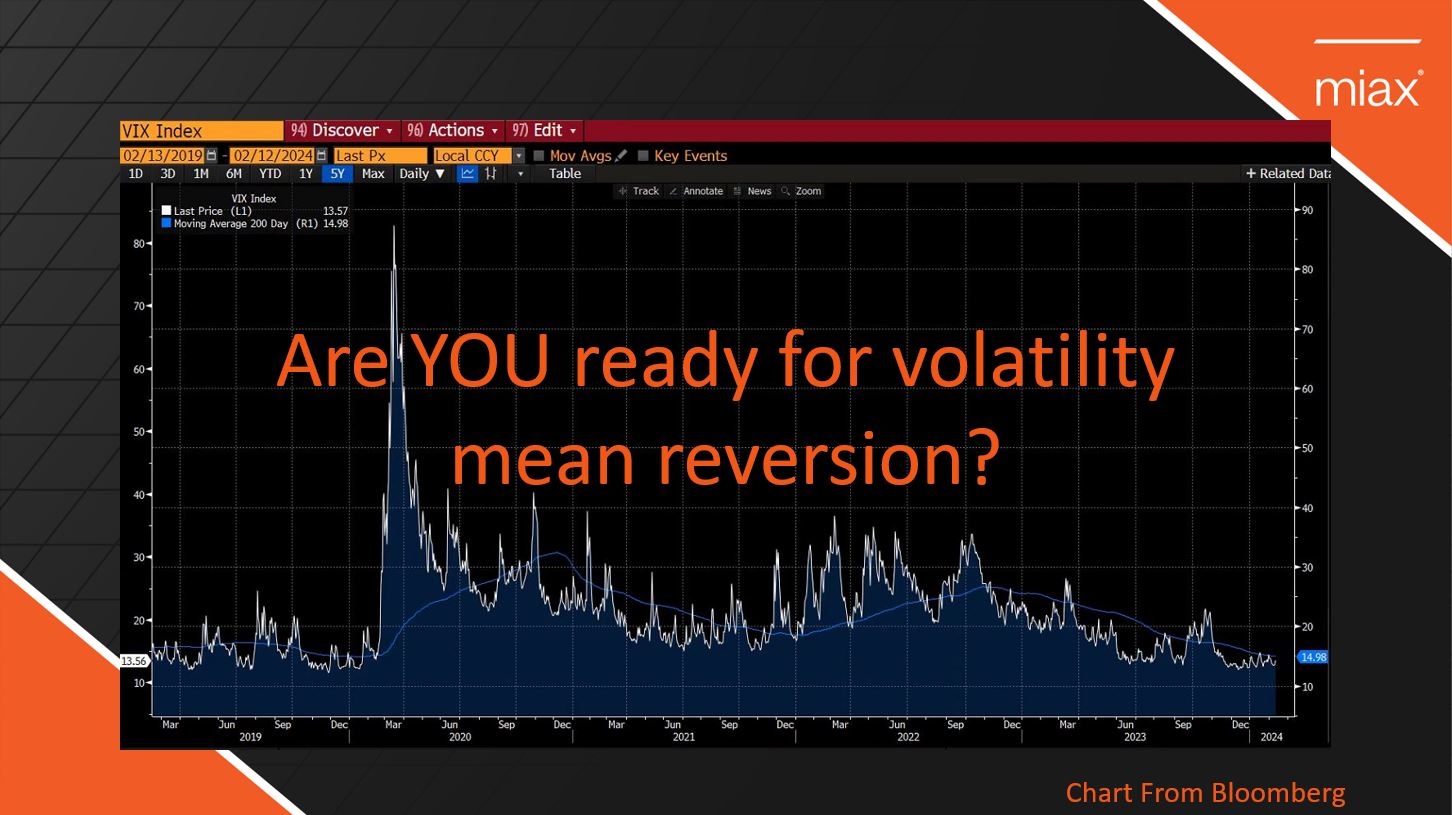

VIX only go above 45 around 10 times: Russian financial crisis, Long Term Capital Management fallout, 911 world trade center attacks, worldCom bankruptcy filling, lehman brothers collapse. Only in 2008 VIX continued to go higher to 80 and it is highly unlikely to sustain the 40s level.

Brian Stutland

Brian Stutland

Joe Tigay

Joe Tigay