Navigating the Complex Relationship between the Stock Market and the Job Market

Investors and policymakers await the non-farm payroll report to gauge the economy’s strength and the Federal Reserve’s work ahead. However, I’m particularly interested in the trend of unemployment – is it still declining, or has it reached a relative bottom?

The economy’s health is measured by the stock market and unemployment rate. People have viewed them as inversely related in history. A strong economy leads to low unemployment and higher corporate profits, driving up stock prices. Conversely, a weak economy causes high unemployment and lower corporate profits, which can decrease stock prices. However, the relationship is more complex than a simple inverse correlation.

Why Low Unemployment Isn’t Always Good for the Stock Market

It’s a common misconception that low unemployment is always a good time to invest in the stock market. While a robust job market can support economic growth and corporate profits, it’s not always beneficial for the stock market. Low unemployment can indicate that the economy is nearing full capacity, which may result in inflationary pressures and higher production costs that can harm corporate profits. Moreover, low unemployment can cause labor shortages that constrain a company’s growth prospects. Additionally, high employment levels can lead to higher interest rates and tighter monetary policy from the Federal Reserve, which can weigh on the stock market.

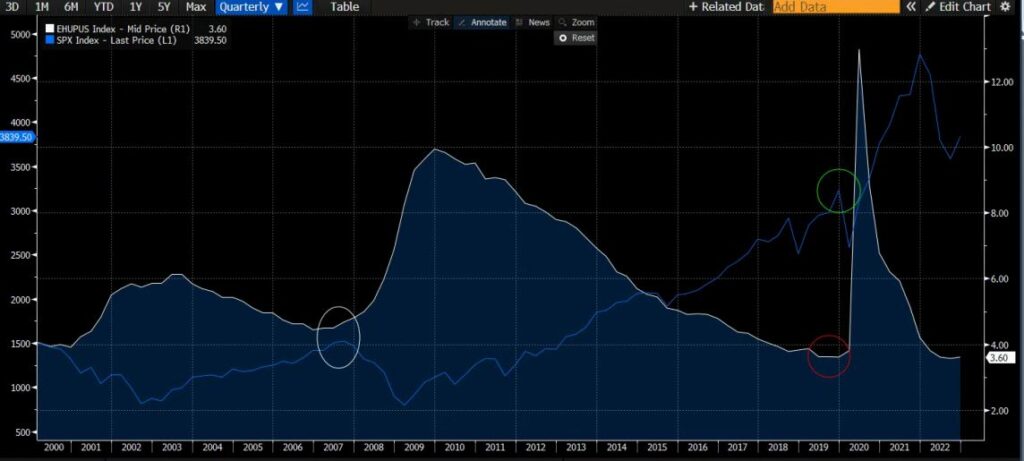

The US has a low unemployment rate, which may indicate the stock market is nearing a top. The crucial aspect to monitor is the trend. As long as jobs are added and unemployment drops, the trend is positive. A significant increase in the unemployment rate would indicate a relative bottom and a warning sign for equities.

Investing in a Strong Job Market: Considerations for Investors

It’s worth noting that other factors are at play as well. For example, interest rates are currently very low, which has helped support the stock market despite the low unemployment rate. Additionally, corporate profits have been strong in recent quarters, which has also helped drive stock prices higher.

While the relationship between the stock market and unemployment rate is not perfect, there is evidence to suggest that the stock market tends to peak around the time when unemployment hits its lowest point in a given economic cycle. However, it’s worth considering alternative explanations for this relationship as well. For example, it could be that other economic factors, such as interest rates or corporate profits, are driving both the stock market and the job market. Alternatively, it could be that the relationship between the two indicators is more complicated than a simple inverse correlation.

Investors should keep this relationship in mind when evaluating the overall health of the economy and making investment decisions. However, they should also be cautious not to view low unemployment as an automatic buy signal for stocks, as there may be potential inflationary and monetary policy implications to consider.

Sometimes, the stock market interprets economic news through a “bad news is good news” or “good news is bad news” lens. For instance, a lower-than-expected jobs number might lead to a temporary stock market boost if the Federal Reserve cuts interest rates. However, the long-term historical relationship between rising unemployment and falling equities cannot be ignored. Ultimately, a strong job market and healthy economy are likely to be positive for corporate profits and the stock market.

Conclusion

The relationship between the stock market and the unemployment rate is complex. While a strong job market can boost corporate profits and drive up stock prices, low unemployment can also lead to inflationary pressures, higher production costs, and labor shortages. Investors should be cautious not to view low unemployment as an automatic buy signal for stocks, as other economic factors, such as interest rates and corporate profits, may also be at play. Keeping an eye on the trend of unemployment can help investors make more informed decisions about managing their portfolios.

Joe Tigay

Joe Tigay