Today will mark the first day of trading of Manchester United stock ($MANU) on the New York Stock Exchange, pricing at $14.00. The club is selling about 10% of the company in order to raise capital to pay off large debts incurred in the club’s 2005 leveraged buyout. Sam Hamadeh, CEO of PrivCo, which researches privately held companies, said “It’s really trading on the level of fan interest as opposed to any sort of financial interest. A winning team does not make a winning investment” (USA Today). Unlike many IPOs this stock is expected to have slow growth, and has lots of debt and exposure to Europe.

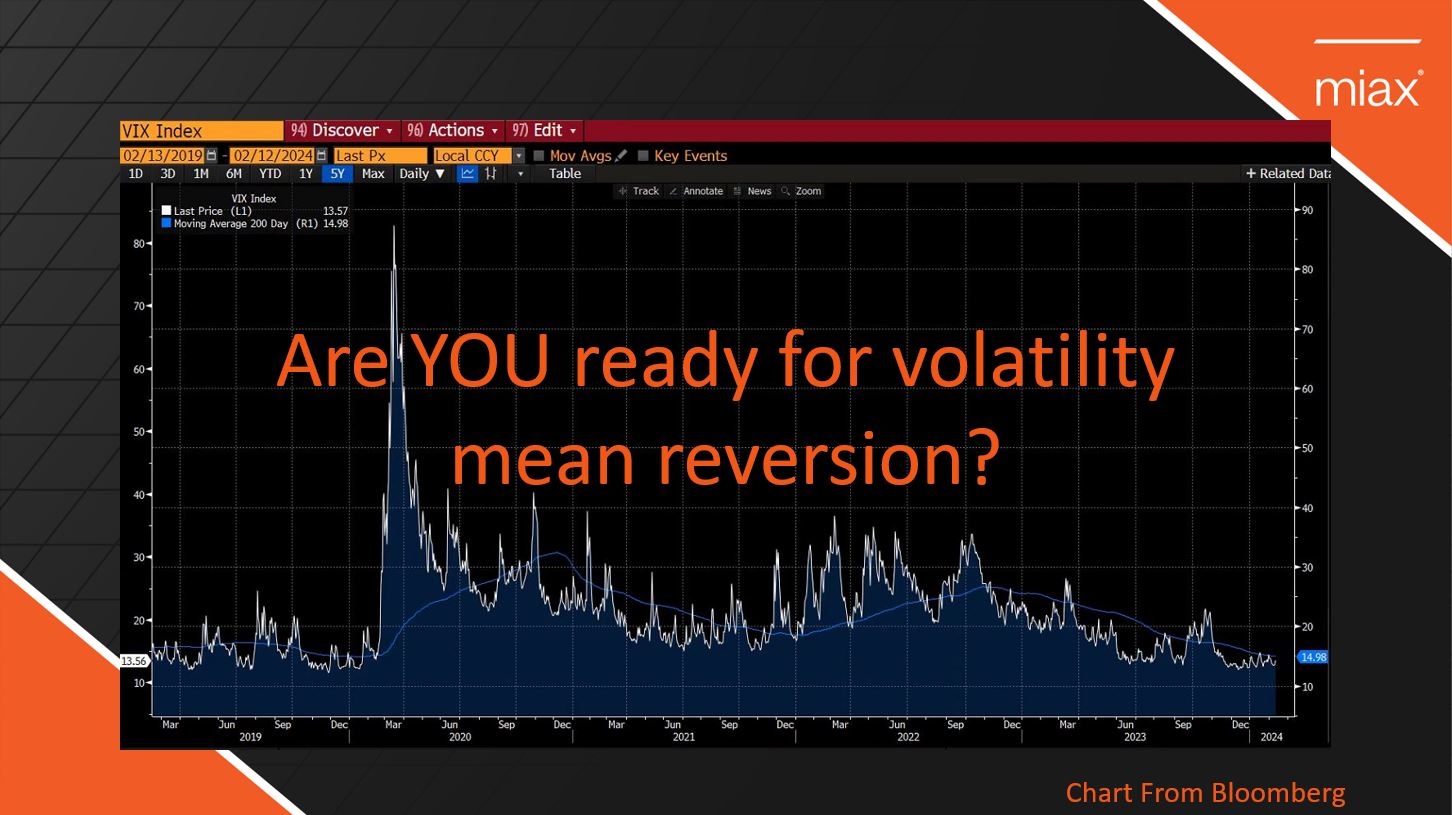

Today we expect the market to remain choppy on light US economic news. We could see some traders taking profits after five days of gains on the weak news out of Europe. Next week could be a bit more volatile with the PPI, CPI, retail sales, industrial production, and housing starts scheduled to be reported.

Brian Stutland

Brian Stutland

Joe Tigay

Joe Tigay