April Market Review: Tech Stocks Continue to Outperform

It’s been another eventful month for the markets, and we’ve seen some interesting trends and indicators worth keeping an eye on. Here are the key takeaways:

Large-cap tech stocks are still leading the charge: As we’ve seen for in 2023, tech giants like Apple, Amazon, and Microsoft, NVidia, Meta, Alphabet continue to dominate the markets. In fact, 97% of the S&P 500’s returns have come from its top 20 stocks.

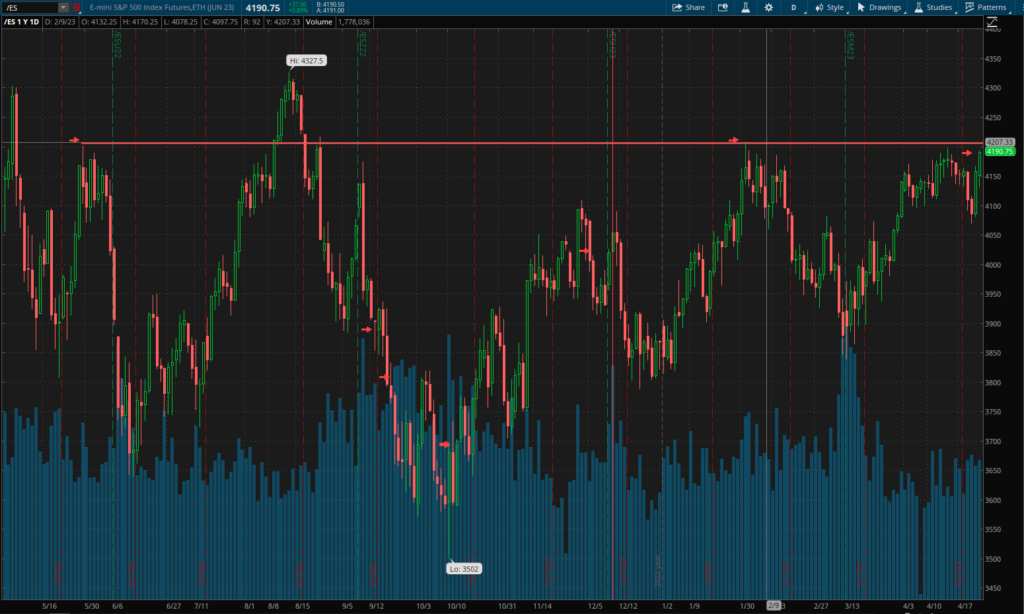

Sell in May?

As stocks ended April close to year-to-date highs, there’s a possibility that a classic “sell in May and go away” scenario might play out. This is a situation that needs to be closely monitored in early May. Especially since next week we have a crucial Fed Meeting and Jobs number.

Money Supply Shrinking

The bond market is currently facing challenges as a funding crunch complicates Fed decision-making, credit is finally tightening, lending is shrinking, and the money supply is contracting. This creates risk for bonds in this uncertain climate. The tighter credit, lowering the money supply is what the Fed hoped to accomplish to lower inflation. We will see how long it lasts and how much damage is done along the way.

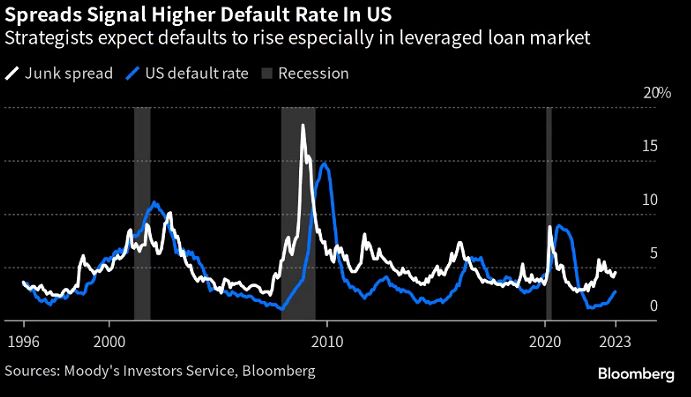

Rising defaults and distressed loans:

The amount of loans trading at distressed levels is up 26% since February, which is a predictor of recessions. Its not at a runaway point yet, but if the Money supply continues to shrink it stands to reason that bankruptcies will be on the rise.

Despite these challenges, it’s important to remember that over the long term, stocks tend to go higher. Investors are positioned to take advantage of this trend while being mindful of the current market environment. Building a volatility position on the current lows is part of the investment philosophy of balancing risk and reward while being mindful of the current market climate.

Volatility has been relatively low in recent months. The MIAX SPIKES Index, which measures volatility on the SPDR S&P 500 ETF, closed April for the lowest monthly close since December 2021. Although this is a positive sign for investors, it’s important to remember that volatility is mean-reverting. This means that small downward moves in the stock market can cause bigger than usual spikes in volatility. Therefore, investors will continue to watch for sudden shifts in market sentiment and adjust their strategy accordingly.

Overall, April provided a lot to consider as investors head into the summer months. The markets will continue to be closely monitored, and strategic decisions will be made based on the investment philosophy.

Joe Tigay

Joe Tigay