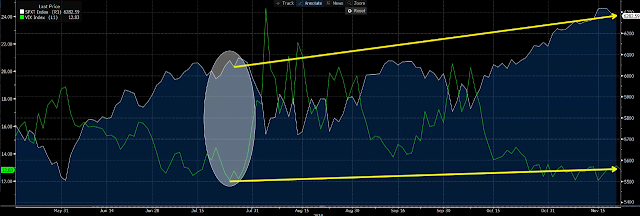

Bridgewater is making a huge put buy in the S&P 500 for early 2020, Id like to take a moment and dive into what exactly is going on from a volatility perspective. Consider this chart comparing the S&P 500 total return (which includes dividends) vs VIX. Over the last 4 months or so the stock market has gone on to make new highs and the VIX is actually up during that time.

Typically, the VIX will move lower when the S&P 500 moves higher as fear subsides when the market rallies. Historically, when I have seen this phenomenon occur where both VIX and SPX increase in value at the same time, it has been a warning sign for stocks. I’m not predicting a global financial meltdown, but this did happen leading up to the last recession.

Take a look at the first April to aug in 2007, which is what led up to the top on Aug 15 2007. The reason being is that the stock market’s torrid pace higher with each pull back only lasting a few days max has made it easy now for option traders to spend a little on option premiums but remain long the market because the cost is so little relative to the upside payoff of being long stocks.

Whether the Bridgewater hedge works or not, I think they are seeing an opportunity to spend very little, 1% like the article says, and protect 2/3 of the funds assets because option prices have become cheap. If the VIX/SPX positive correlation is predicting a major selloff, then hedgers like Bridgewater are taking advantage of cheap prices and yet they still can win to the upside if the market continues in a straight direction up. Because the market is not trending sideways to slightly down and like you said maybe some volatility ahead, they are seeing solid risk/reward opportunity. To quote “White Men Can’t Jump”, “Sometimes when you lose you really win.” In this case, spend and lose a little on option premium to win to the upside on your long stock and maybe also win by being protected in case you lose on your stocks.

Brian Stutland

Brian Stutland

Joe Tigay

Joe Tigay